Financial Focus: Tax Season 2021 — How to turn $20 into a $1,000 Tax Refund!

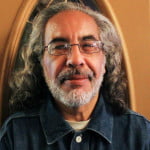

By Professor Anthony Rivieccio MBA PFA

Just got your taxes done? Not happy? Government took too much? Too little?

Let me be frank!. Understanding the true concept of taxes is hard for most. Why? Because they want it both ways! Let me pay the lowest that I can during the year– so when it’s tax refund time, I expect a Billion!!😳😳

Well not withstanding that illogic, which applies to 70% of Americans, let me nevertheless, address the topic above, how can I get an extra $1,000 Tax refund ,for only $20? I lied!

You can actually get $2,000 back, if you want to invest $40?. Maybe even more!!! How?

Well, if we’re just talking your Tax Refund only then , let the IRS & State be your 1 year forced bank account!. Confused ? Let me make it simple- take $20 out of your check. If you get paid weekly, the yearly sum will be $1,080.

If most things remain equal in your tax file from one year to the next, then your tax bracket should be the same ( check with your tax professional ). If it is, then anything extra- you get all back.

So, how can you get started: It’s called a W-4 form at work.

A W-4 form tells the employer the amount of tax to withhold from an employee’s paycheck based on their marital status, number of allowances and dependents, and other factors. The W-4 is also called an Employee’s Withholding Allowance Certificate.

So as I mentioned earlier, if , from one year to the next, if you are still in the same bracket, then ask your boss for a form now and ask your tax professional to fill it out for you and request $20 to be taken out of your Federal taxes.

The sooner, the better!.

Remember, you will not get the full maximumization until a ” full calender year” of applying goes into place.

An example: If you applied it on April 1st 2022, then that would be 9 months, 39 weeks of execution , until December 31, 2022.

January 1, 2023, next year, it’s income tax season, 2022. When you get your taxes done, the government owes you $20 for 39 weeks, or an extra $780 on your Federal Tax Refund.

Tax Season, 2023, a full calender year cycle would have taken place and that $1,080 extra will kick in, year after year after year.

On Friday, March 11th, Live at 5PM on The NY Parrot TV internet streaming channel on Facebook & YouTube, I will be hosting a special segment on this subject matter, please feel free to tune in

Professor Anthony Rivieccio, MBA PFA, is the founder of The Financial Advisors Group, celebrating its 25th year as a full service investment planning & management firm . Anthony is also owner of Rivieccio Financial Advisors, a virtual only financial planning & advisory firm, opened in 2021.

Mr. Rivieccio, a recognized financial expert since 1986, has been featured by many national and local media including: Kiplinger’s Personal Finance, The New York Post, News 12 The Bronx, Bloomberg News Radio, BronxNet Television, the Norwood News, The West Side Manhattan Gazette, Labor Press Magazine, Financial Planning Magazine, WINS 1010 Radio, The Co-Op City News, The New York Parrot, The Bronx News, thisisthebronX.info , The Bronx Chronicle & The Parkchester Times. Mr. Rivieccio also pens a financial article called “Money Talk”.

Anthony is also currently an Adjunct Professor of Business, Finance & Accounting for both, City University of New York & Monroe College, a Private University.

For financial assistance, Anthony can be reached at (347) 575-5045. Have Facebook? My email is a_rivieccio@yahoo.com My personal page is www.facebook.com/anthonyfromthebronx