Financial Focus: Retirement Planning Success — from Today to Tomorrow ( part 2)

Professor Anthony Rivieccio

In our last week’s article ( part 1), we discussed that I was finishing up my Retirement Planning class with my students ( they are all scheduled to get an A prior to the final) and I was a bit disappointed on the syllabus.

The content was created more toward ” employee benefits” and they learned all about Retirement products in and out of their job.

Because only 10% of the chapter is more individual based, I am trying to carve out a way to teach ” family based Retirement Planning” to them

This entails learning the “number crunching ” involved in how to answer true retirement questions, like a simple example: ” How much do I have to save for my Retirement? And for how long?

As I mentioned in the first article, their are many methods and formulas that are now integrated into financial calculators & software and cloud based packages. I did not want them to spend a few hundred dollars on a financial calculator so I thought I would show them via regular math. However, I mentioned to them that a regular calculator will be only 85% efficent.

In simple terms, I suggested to them that they should learn the Annuity Method formula.

Now before we can start number crunching as I said in part 1, first you need ” the factors”.

The variables needed to determine are :

- Today’s Salary

- Social security in today’s dollars

- Work Life Expectancy ( how much longer do you plan on working)

- Inflation, today & tomorrow’s

- Retirement Life Expectancy ( how long you plan to live in Retirement)

- Interest rate of Savings, today & tomorrow

Based on these variables you can number crunch into what is called ” The Annuity method”. This method relates to the time value of money. This approach is designed to determine the amount of money that must be accumulated at Retirement and the amount of money that needs to be saved each year until retirement

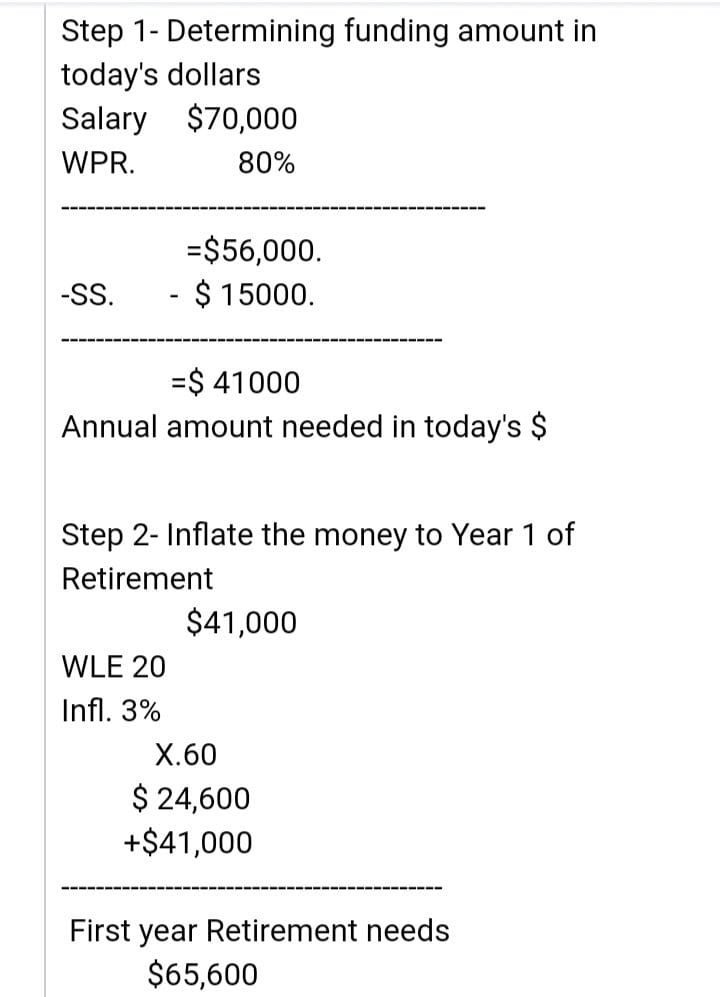

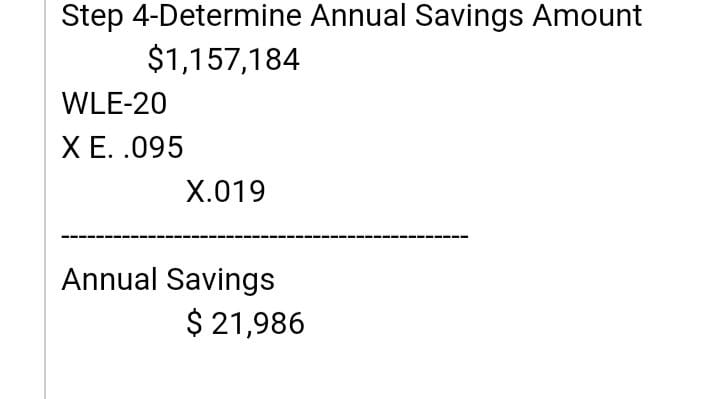

So Jordan is age 42, makes $70,000 a year , her wage replacement ratio is 80%.She wants to retire at age 62 and live till age 90. She expects her investments to earn 9.5% and inflation to be 3%. She is expecting an annual Social Security henefit of $15,000

Now we put the factors in and number crunch

So now that we understand the variables above, this is the math ( or the sugar bowl) we will use to stir the ” eggs” into the ” pot” and be prepared to ” cook”.

Or in simple terms, this is her Retirement Plan.

Professor Anthony Rivieccio, MBA PFA, is the founder and CEO of The Financial Advisors Group, celebrating its 24th year as a fee-only financial planning firm specializing in solving one’s financial problems. Mr. Rivieccio, a recognized financial expert since 1986, has been featured by many national and local media including: Kiplinger’s Personal Finance, The New York Post, News 12 The Bronx, Bloomberg News Radio, BronxNet Television, the Norwood News, The West Side Manhattan Gazette, Labor Press Magazine, Financial Planning Magazine, WINS 1010 Radio, The Co-Op City News, The Bronx News, thisisthebronX.info, The Parkchester Times, The Red Parrot and The Bronx Chronicle. Mr. Rivieccio also pens a financial article called “Money Talk”. Anthony is also currently an Adjunct Professor of Business, Finance & Accounting for both, City University of New York & Monroe College, a Private University. You can reach Anthony at 347.575.5045.