Staged Car Crash Fraud Costs New York Drivers $300 More Annually, Group Warns

Citizens for Affordable Rates (CAR) has issued a consumer alert warning that staged car crashes orchestrated by criminal networks are driving up auto insurance premiums across New York State, costing drivers an average of $300 more per year.

According to CAR, these organized fraud rings are a major factor behind New York’s skyrocketing auto insurance rates, which stand about 40 percent above the national average. The advocacy group said millions of working families are being forced to choose between maintaining car insurance and covering essential expenses such as groceries.

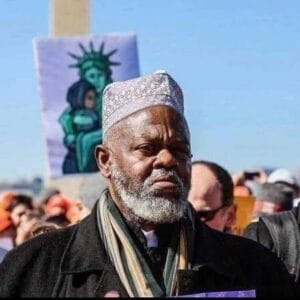

“Staged car crashes are organized criminal enterprises preying on hardworking New Yorkers and costing every driver an extra $300 a year in premiums,” said José Bayona, a spokesperson for CAR. “We are issuing this urgent warning so consumers can protect themselves and understand why insurance costs are climbing so steeply.”

The group’s fact sheet details how the schemes work. Fraudsters intentionally cause collisions using tactics such as “brake slamming” and “swoop and squat” maneuvers. After the staged crashes, fraudulent medical clinics — referred to as “medical mills” — submit inflated bills that can exceed $50,000 per fake accident. Corrupt attorneys then file sham lawsuits to extract large settlements from insurers, with the costs ultimately passed on to consumers.

Data from the New York State Department of Financial Services shows that staged accidents and exaggerated medical claims account for roughly 75 percent of all insurance fraud cases in the state. This adds an estimated $300 to every driver’s annual premium. On average, New Yorkers pay $4,031 a year for full coverage, while 5.2 million residents live in areas where car insurance is considered unaffordable. Around 11 percent of drivers remain uninsured.

CAR noted that New York’s no-fault insurance law, which requires insurers to pay medical claims within 30 days, gives criminals an opportunity to exploit the system before investigations can be completed. The group warned that the growing number of uninsured drivers and hit-and-run incidents further endangers the public.

The organization urged Governor Kathy Hochul to take immediate steps to curb the crisis by extending the investigation period for suspicious claims, cracking down on fraudulent medical clinics and attorneys, and imposing stricter penalties, including jail time and asset forfeiture, for those involved in organized insurance fraud. CAR also called for the creation of specialized prosecution units to target staged accident networks.

“Governor Hochul can end this crisis with the stroke of a pen,” Bayona said. “New York families are bleeding money every single month while Albany dithers. The Governor must act now and restore fairness to the auto insurance market.”

Citizens for Affordable Rates (CAR) is a coalition of citizens, advocates, and organizations dedicated to addressing the root causes of high insurance premiums in New York through advocacy, education, and policy reform.