NYC Council passes Intros 2039-A, 1225-A to assist property owners

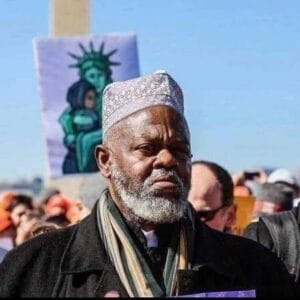

Th New York City Council has passed Intros 2039-A and 1225-A, two bills prime-sponsored by Council Finance Chair Daniel Dromm

The bills are aimed at helping City property owners keep their homes during these unprecedented times.

According to Dromm, Intro 2039-A would retroactively extend the filing deadline for an initial or a renewal application from March 16, 2020 to July 15, 2020 for various real property tax exemption/abatement programs that were due in calendar year 2020.

“Approximately 2,650 eligible initial and renewal applications were received after the existing deadline, but prior to July 15, 2020,” he NYC Department of Finance said in a statement.

It added that this legislation would permit the approval of these applications this year rather than requiring the homeowners to wait until next tax year to qualify for benefits.

“Intro 2039-A will help hundreds of New Yorkers keep their homes,” said Dromm.

He stated that the COVID-19 pandemic hit New York City like a bolt of lightening in late March of this year.

“Shortly before the mass hospitalizations, the busiest City in the world went silent as millions of New Yorkers went into lockdown as ordered by the City and State.

“Mid-March was one of the most frightening periods of this City’s history as we were awaiting the approaching storm, and contending with a virus that almost completely unknown to us.

“Amidst the fear and confusion of the early days of the COVID-19 pandemic, many homeowners missed these program deadlines.

“This is an understandable oversight–but it is one that could have had dire consequences for the many working families who rely on these exemptions and abatements to keep afloat financially.

“This retroactive extension will keep homeownership affordable for many people with lower incomes. I want to thank the administration, Speaker Johnson and my colleagues for prioritizing this effort that will prevent these homeowners from suffering undue hardship during already-difficult times,” he added.

Intro 1225-Awould require the Finance Department to make best efforts to collect the name, telephone number, and email address of every owner of real property in the city, or of an equivalent representative, and to maintain such information in a database used for purposes of administering property taxes.

Currently, the Department does not have a systematic way of collecting and maintaining contact information other than a physical mailing address for property owners. Email and telephone information are crucial for efficient communication.

This legislation encourages the Department to ensure that emphasis is also placed on those alternative and often preferred means of contact.

Dromm continued, “Intro 1225-A will help City officials conduct quick and efficient outreach to homeowners. As a Council Member, I find it extremely frustrating that the New York City Department of Finance asks us to reach out to our constituents about critical issues like the lien sale or renewing property tax exemptions without providing phone numbers or email addresses.

“Right now, all my office can do is send another snail mail letter. In many instances, we can save low income and middle class homeowners from the terrible experience of having a lien placed on their property simply by notifying them in a timely manner. We are in the middle of a pandemic and housing insecurity is on the rise.

“As elected officials, we must do everything in our power to help homeowners during these extremely challenging time. This common-sense effort does just that. I thank Speaker Johnson and my colleagues for theirdedication to homeowners across the city who stand to benefit from this legislation.”